If you are thinking of how to start a snow plowing business, you have come to the right place!

The snow plowing business is a lucrative opportunity, especially in regions blessed with abundant snowfall. Snow plowing can be an awesome way to make good money in the wintertime, and in the warmer months, you could use your truck to do other things, like junk removal, and many more tasks.

If you are an aspiring entrepreneur or an established lawn care professional looking to expand your offerings, the below checklist will help set you up for success this winter.

In this guide, we will walk you through the required steps to launch your snow-plowing business successfully. From researching the market to obtaining the necessary licenses and permits we will equip you with the knowledge and tools needed to start your business.

The key to starting towing business is to obtain the right knowledge and avoid all the usual mistakes.

Start a Snow PLowing Business by following these 11 steps:

- Research the industry & know if the business is right for you

- Work on Your Idea

- Decide on the Snow Plowing Company Name

- Create a solid business Plan

- Register Your Business

- Register for Taxes

- Fund Your Business

- Apply for a Snow Plowing Business License and Permits

- Open a Business Bank Account & Credit card

- Get Business Insurance

- Prepare to launch

Step 1: Research the industry & know if the Snow Plowing business is right for you

| Key U.S. Snow Plowing Industry Statistics | |

| The Market size of the snow plowing services industry (2022) | $25.4 billion |

| The average growth rate between 2017 $ 2022 | 5.1% |

| The number of snow plow operators currently employed in the U.S. | 11,159 |

| Male snow plow operators | 90.6% |

| Female snow plow operators | 9.4% |

| The average age of the snow plow operator | 47 years |

| The average level of education | High school |

| Most popular states for snow plowing business | Alaska, Idaho, North dakota |

| Least popular states for snow plowing business | Michigan, Arkansas, Mississippi |

| Percentage of the U.S roads located in snowy regions that receive more than five inches (or 13 cm) of average snowfall annually | 70% (approx.) |

| Percentage of the age of the U.S. population lives in these snowy regions | 70% (approx.) |

| Percentage of weather-related vehicle crashes that happen during snowfall | 15% |

| People killed in vehicle crashes during snowfall | 900 |

| Percentage of winter road maintenance budget | 20 % of state DOT maintenance budgets. |

| Amount spent by State and local agencies on snow and ice control operations annually | 2.3 billion |

Fast Facts of Snow Plowing Business

| Is the Snow Plowing Business Meant for You? | |

| Industry Trend | Growing |

| Commitment | Flexible |

| Investment Range | $9,400 – $20,850 |

| Revenue Potential | $25,000 – $180,000 p. a. |

| Profit Potential | $20,000 – $55,000 p. a |

| Time to Build | 1 – 3months |

Note: This is only an estimation, actual numbers may vary depending upon many factors such as the number of vehicles, location, offerings, etc.

Pros & Costs of a Snow Plowing Business

Every business comes with its own pros and cons, and the snow plowing business is no exception to this. Before you decide on starting a snow plowing business you should consider all pros and cons.

| Pros | Cons |

| Low start-up cost: If you already own a truck and equipment, starting a snow plowing business can be quite affordable. | Weather Dependency: The snow plowing business is heavily reliant on weather conditions, which makes it unpredictable and subject to fluctuations. |

| Flexibility: You can set your own schedule and deadlines. | High competition: You need to differentiate your services to attract clients, as there is already high competition. |

| More profit in a short period: Depending on the location and the number of clients, you can make substantial profits in a short period | Equipment maintenance: Regular maintenance of snow plowing equipment can increase your operational costs. |

| Local community: You can develop a local following and thus you can have access to additional revenue streams and loyal customers | Difficult to run your business from home: You are more likely to run your business out of your office or storefront space. |

| Relatively recession-proof: The demand for snow plowing business is increasing every year and the business is relatively recession-proof. |

Trends & Challenges of a Towing Business

Trends

- Technology advancement: To remain ahead in the competition you have to adapt to the latest trends in the snow plowing business such as mobile technology, GPS equipment for trucks, automated winter equipment, automated billing and invoicing, and more.

- Emphasis on sustainable practices: Property owners and managers are increasingly interested in following SWIM guidelines, NGOs, and water quality initiatives, meaning the salt chloride levels need to decrease. There is a decline in the use of traditional deicers, contractors treat rock salt with liquid deicers, which ultimately puts fewer chlorides into the environment.

Challenges

- Unstable weather: Climate change is making weather more unstable, which means uncertain income in the snow plowing business.

- Labor shortages: Labour shortages are making it harder for snow plowing companies to find workers. Some companies are even increasing their rates or knocking down other barriers to entry to entice people to join their organizations.

How much does it cost to start a snow plowing business?

Startup costs for a snow plowing business range from $9,400 to $20,850. The major part of the cost is the acquisition of a truck. An upfront payment would be required to make a down payment When you are just starting out it’s always a good idea to go for a used truck instead of a new one, these will save on the cost. Additionally, you will require a handful of equipment and licenses.

| Cost Type | Cost range | Average |

| Truck Down payment | $2,000 – $5,000 | $3,500 |

| Licenses and permits | $100 – $300 | $200 |

| Website Setup | $1,000 – $3,000 | $2,000 |

| Marketing and advertising | $800 – $1,500 | $11,500 |

| Insurance | $100 – $300 | $200 |

| Software | $100 – $250 | $175 |

| Equipment | $5,000 – $10,000 | $7,500 |

| Miscellaneous | $300 – $500 | $400 |

| Total | $9,400 – $20,850 | $25,475 |

Please note that these are just rough estimates. The start-up cost of starting a snow plowing business will depend upon your location, the size of your service area, the size of your team, and the types of equipment needed for your business model. Before you launch your business it’s very important to research all costs and make a detailed plan that includes all expenses.

What equipment and tools are required to start a snow plowing business?

Another important step while starting a snow plowing business is choosing the right equipment and tools. Without efficient tools and equipment, you can’t operate an efficient business.

The basic equipment required to start a snow plowing business are:

- Truck

- Plow

- Snowblower

- Salt sprayer

How much can you earn from a snow plowing business?

Even though, you will only work in the winter season, the business is still profitable. In the U.S., the average annual pay for individuals who plow snow is $49,365 and this comes to $23.73 an hour, $949/week, or an average of $4,114/month. Some might end up earning as low as $21,500.

The earning is highly affected both positively and negatively by various factors such as:

- The size of your business,

- Location of your business

- Number of employees.

Step 2: Work on Your Idea

Now that you have a fair idea about the snow plowing business, it a time to enter the competitive market.

Market research is the first important step at this stage. You must know whom you are going to compete with, how you will differentiate your services from others, what services you will offer t, what services to specialize in, etc. are some of the key points you should consider.

Decide what services to offer

The most important task at this stage is to examine services offered by your competitors, their pricing, and customer reviews. You must find out gaps in the available services. It could be possible that the local market is missing a snow plowing company that also does sidewalk shoveling, ice removal, or roof snow removal.

The Important thing is to specialize in a particular niche idea, for example, you can specialize in snow plowing of only residential area or business parking lots.

How much should you charge for snow plowing services?

In the U.S. snow plowers charge around $25 to $75 per hour, with contract prices at $200 to $600 per season. Commercial snow plowing rates vary between $50 to $200 per hour for parking lots and $150 to $300 per acre for salting.

You should aim for a profit margin of 70-80%. Keep in mind that the prices you use launch should be subject to change if warranted by the market.

Who is your target market?

Your target market will depend upon the niche you specialize in. In general, the target market could be among the following categories.

- Homeowners

- Commercial clients

- Property management companies

- Homeowners’ Associations (HOAs)

You can find your prospective clients on LinkedIn, Facebook and Instagram or you can search for local businesses on Google and Yelp. You can also call them directly.

Choose your business premises

It’s a wise idea to operate from home in the initial stage of business development so that your expenses remain minimal. Once your business grows operations intensify, and you will need to hire workers for different job roles and may need to rent out an office or shop.

You can check sites such as Craigslist, Crexi, or Instant Offices that rent commercial space. Follow these thumb rules while choosing your office or shop:

- Must be centrally located and accessible via public transport.

- Must be well-ventilated and spacious, with good natural light.

- A competitive rent.

- Flexible lease terms. You may want to extend as your business grows.

- Ready-to-use space with no major repairs or renovations required.

Step 3: Decide the Snow Plowing Company Name

The business is your identity and should convey your objectives, services, and mission. make sure that your company name is short and easy to remember.

Choosing the right business name is important and challenging too. If you operate a sole proprietorship, you might want to operate under a business name other than your own name.

- Research your business name well by checking

- Your state’s business records

- Federal and state trademark records

- Social media platforms

You can check the availability of related domain names using various domain name search tools like godaddy.com. It’s wise to use a .com extension as it increases credibility.

Keep in mind that the name should be

- Keep it simple: When the name is simple and straightforward, it makes it easier for the customers to find and refer you to others. Complex names may be confusing and customers may find it difficult to spell or pronounce.

- Industry relevant: Use the words such as “snow”, “plowing”, or “snow plowing”, so that customer gets the message about your business. The name should convey what business you are in.

- Keep your audience in mind: Choose a name that resonates with your audience. An audience-related name will help build a strong connection and build loyalty.

- Keep it short: Short names are easier to remember and recall. They are more visually appealing on signage and marketing materials.

- Memorable: A memorable and catchy name will remain in the minds of the customers and will help them recall when they need your services.

- Bold & Creative: Let the name be funny or playful. Such names can help your business name stand out and remember more easily.

- Avoid location-based names: Avoiding location-based names might hinder future business expansion.

- Ask around: Ask friends, family, colleagues, social media, etc. for suggestions.

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration.

Design Logo for your business

Source: Venngage

Logo is a symbolic representation of your business. Apart from the tips listed above, remember the following points when deciding your logo:

- Keep your logo simple but not simplistic

- Your logo is an honest reflection of your dump truck business.

- Black and white color combination goes well with logos.

- Logo should be balanced; one element should overpower another.

Step 4: Create a solid business Plan

Once you are confident with your skills, it’s time to create a solid business plan and start building your own business. A detailed business plan will help you with your goals, target audience, financial plans, business structure, and more.

Your business plan will function as a guidebook to take your business through the launch process and maintain focus on your key goals.

There is no right or wrong way to write a business plan. You can choose the best format that suits your business. The business plan can be one-page format as above or it can be a traditional way as below.

The key points to include in your business plan are as under.

- Executive Summary: It provides an overview of the entire business plan, highlighting the key points and objectives. The executive summary should be written once the plan is complete.

- Business Overview: Here, you should mention an in-depth overview of the business, including its vision, mission, ownership structure, and corporate goals. Make sure you mention the core values and unique qualities of your business that differentiates you from the competitors.

- Product and Services: Describe your services in detail. Must Include information on the different packages and add-ons.

- Market Analysis: Conduct a thorough market analysis, including trends, demand variations, potential areas for growth, and more. Perform a SWOT analysis to identify strengths, weaknesses, opportunities, and threats.

- Competition Analysis: Analyse your competitors, assess their strengths and weaknesses, and write the advantages of your services as compared to the services offered by the competitors.

- Sales and Marketing: Decide your company’s USPs and create sales, marketing, and promotional strategies. Create strategies related to pricing, advertising, lead generation, and referrals.

- Management Team: Give an overview of the management team, their roles, responsibilities, and professional backgrounds. Also, include an organizational chart or a corporate hierarchy.

- Operations Plan: The operation plan will include procurement processes, assets and equipment, office location, and logistical details.

- Financial Plan: The financial plan will demonstrate the financial viability and sustainability of the business and will cover, start-up costs, break-even analysis, profit and loss estimates, and details of the cash flow balance sheet.

- Appendix: This may include additional documents that support the information presented in the business plan, like research data, sample contracts, and other relevant documentation.

Step 5: Register Your Business

Registering your business is an essential and vital step in starting a business. It is a basic requirement for tax payments, accessing capital, opening a bank account, and other related aspects of establishing your business.

The registration process is exciting as it formalizes your business. Once completed, you will have your very own business!

Choose where to register your company

The location of your business is an important part of your business as it affects taxes, legal obligations, and revenue generation. Generally, it makes sense for small businesses to select the home as your state of domicile, but if you have plans for expansion you should also explore other options. Few states may have additional benefits for your business.

Registering your business in other states involves a simpler registration process through the secretary of state. In states beyond your home state, your business is considered a foreign entity.

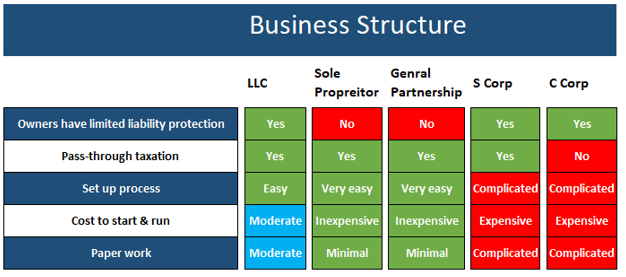

Choose your business structure

Business entities are of various types, and each has its own set of advantages and disadvantages. The company structure you choose will have an impact on factors such as tax obligations, personal liability, and registration requirements. So, make a well-informed decision.

Your options are:

- Sole Proprietorship – Sole proprietorship makes no legal distinction between the company and the owner. It gives you complete control over your business. All income goes to the owner, and the owner is liable for any losses, debts, or liabilities incurred by the business. The owner has to pay the taxes on business income on his or her personal tax return.

- Partnership – This business structure is similar to a sole proprietorship, but owned by two or more individuals. Partnerships are of two types: a general partnership (everything is equally shared between the partners) and a limited partnership (operations are controlled by one partner).

- Corporation – In this type, a business entity is separate from its owners. Shareholders are not personally liable for the company’s debts and obligations.

- Limited Liability Company (LLC) – The LLC Combines the benefits of corporations and partnerships. Profits and losses pass to owners and the business doesn’t get taxed. The owners are not personally liable for debts.

For a small business, an owner LLC is a better option because it offers liability protection and pass-through taxation and it’s simpler to form an LLC compared to a corporation. There are a good number of LLC formation services available online that can form an LLC in five minutes.

Step 6: Register for Taxes

The last step before you are able to pay taxes is getting Employer Identification Number or EIN. You can apply online through the IRS website and get EIN in a few minutes. If you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN. An EIN can help you at the time filing business taxes to get a business credit card and open a business bank account.

IRS website also offers tax payers checklist, and taxes can be filed online.

Once you get an EIN, you need to choose a tax year, which can be (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, and which taxes you’ll pay will be determined by your business structure.

It is a wise idea to consult an accountant or other professional to help you with your taxes.

Step 7: Fund Your Business

To operate a box truck business, you will need funds. Financing can come in various forms as below.

- Your own money: You can fund your business through your personal savings or the sale of property or other assets.

- Friends and Family: You can reach out to your friends and family for loans or investments in your business. You should get legal advice when doing so as SEC regulations apply in this case.

- Crowdfunding: Crowdfunding involves funding a project by raising many small amounts of money from a large number of people, typically via the Internet.

- Bank loans: This is the most common method of securing financing for a small business but getting approved requires a very good business plan and strong credit history.

- SBA-guaranteed loans: In this case, The Small Business Administration (SBA) can act as as guarantor and helps to gain the bank’s approval via an SBA-guaranteed loan.

- Government grants: There are various financial assistance programs to fund entrepreneurs. To know more visit Grants.gov

- Venture capital: Venture capital (VC) is a form of private equity and a type of financing that investors provide to start-up companies and small businesses that are believed to have growth potential.

When you are just starting a business, venture capital may not be the best option. You need to offer an ownership stake to the investors in exchange for funds and obviously have to sacrifice some control over your business. You can think of this option only when you’re ready to grow your business to a large scale.

Step 8: Permits and licenses required to start a towing business

Check the necessary permits and licenses with your state’s website to ensure that you meet all requirements for the business license. For specific permits, you must check with the state and local city county clerk’s office.

You can check the SBA guide for your state’s requirements. Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration (OSHA), copyrights, trademarks, patents, and other intellectual properties and industry-specific licenses and permits.

Step 9: Open a Business Bank Account & Credit card

Before you start your business, and make money you will have to open a bank account.

You may keep your business finances separate from your personal account to simplify filing taxes and tracking your ice cream truck business income, even if you operate it as a sole proprietorship. Opening a business bank account is quite simple, just inquire at your preferred bank to know about their features and rates.

Once you decide on your bank bring in your EIN (or Social Security Number if its sole proprietorship), articles of incorporation, and other legal documents and open your new account.

You may also need a business credit card, especially for events requiring a heavy expenditure. Compared to other types of credit, it is easy to qualify for credit cards when you are a brand-new business. Having funds available in case of emergency is always intelligent.

Step 10: Get Business Insurance

It is very important to have appropriate insurance for your box truck business as insurance protects you from devastating consequences resulting from unexpected events.

In order to operate safely your business needs insurance, it protects your company’s financial well-being in the event of a covered loss.

- General Liability Insurance: General liability insurance protects your business from claims that it caused bodily injury or property damage to someone else. Many small business owners also get a general liability insurance policy that includes product liability insurance that protects their company from claims of bodily injury or property damage that their products cause.

- Professional Liability: Professional liability insurance helps cover claims related to mistakes in the professional services that your business provides to the clients. For example, if your accounting firm makes a mistake on a customer’s financial statement and they have to pay a penalty. If they sue your business, professional liability insurance can help cover your legal costs.

- Worker’s compensation: Workers’ compensation insurance provides benefits to employees if they get an injury or illness because of the work.

- Commercial Auto: Commercial auto insurance provides protection to company-owned vehicles.

- Business Property: Business property insurance Provides coverage for your supplies and equipment.

- Commercial property: Commercial property insurance helps protect your owned or rented building and the equipment used to operate it. So, if someone breaks into your building and steals your business computers, commercial property insurance can help cover the replacement costs.

- Equipment breakdown insurance: Equipment breakdown insurance covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Business owner’s policy (BOP): This is one of the popular insurance policies and combines general liability insurance commercial property insurance and business income insurance.

Step 11: Prepare to launch

Develop your website

Your business website serves as your online presence and plays a critical role in convincing potential clients of your expertise in the field. You can utilize user-friendly platforms like WordPress, Wix, or Squarespace but it may require some time and effort to familiarize yourself with the website-building process. If you are not technically sound you can hire a skilled web designer and get the things done. To increase the visibility of your website in the search engines like Google, you need to apply Search Engine Optimization (SEO) strategies so that prospective clients discover your website easily.

Marketing

Online visitors may visit your website and bring in some business but to get more leads you must invest in digital marketing. For a new business, it’s very important to build brand awareness.

Social media platforms like Facebook, Instagram, Pinterest, etc. are another better option for diverting traffic to your website. Link your business website to all your social media accounts and keep posting engaging content and advertise your services.

- Facebook: Facebook is the largest social networking site in the world and it’s a great platform for paid advertising. It allows you to target specific demographics, like children under age 15 in Portland.

- Instagram: It is a great visual social networking platform and an ideal place for showcasing your products or services with photos or videos. It has the same benefits as Facebook but with different target audiences.

- Website: A good SEO will help your website rank higher in the search results and the prospective clients will discover your business portal easily, this in return will bring in more sales. Add the right calls to action with attractive font and color.

- Google and Yelp: List your services on Google My Business and Yelp if you want to focus on local clientele.

Increase awareness and build your brand

Once you have your website ready and presence in the social media do some real-life activities to increase awareness of your brand. Some of the activities you can do are:

- In-Person Sales: Local markets and trade shows are great places to offer your products.

- Ask for referrals: Offer some incentives to the clients who bring in new customers.

- Post a video on YouTube, Facebook, and Instagram: Post an awesome video of your snow plowing activity and show how meticulously to did the task.

- Start a blog: Start a blog with a good user interface and share knowledge and experiences that prospective clients may find useful. Add eye-catching infographics to your posts.

- Testimonials: Share maximum testimonials on the platforms where you have a presence.

- Giveaways: Offer prizes and discounts for customers who complete a certain action, such as 40% off your first order.

- Flyering: Distribute flyers in your neighborhood, community centers, and more.

Must have tools & software

There are many software and digital tools available in the market that can simplify your business tasks and make life easier. Some of the well-known software you can consider to easily communicate with customers, manage and keep track of inventory, allow customers to track the repair process, and

You may want to use industry-specific software, such as Service AutoPilot, Jobber, or connecteam, to manage your appointments, invoicing, and payments.

Accounting

There are some popular web-based accounting programs, especially for small businesses such as Freshbooks, Quickbooks, and Xero.

You can also think of hiring a professional if you are unfamiliar with basic accounting because mistakes in filing incorrect tax documents can lead to severe consequences.

Focus on USPs

Unique selling propositions (USPs) are the unique features of a product or service that differentiate your service from your competitors. Customers, today have so many options but if they grasp your service quickly and understand how your service meets their needs, then you will have a real advantage.

Some of the best USPs you can have are:

- Round-the-clock snow plowing services

- Powerful snow plows to specialized snow blowers.

- We prioritize environmentally friendly snow removal practices

- Residential driveways to large commercial properties

- State-of-the-Art Equipment and Technology

Network

A good network of people related to the snow plowing industry is a must to expand your business. Reach out to your existing personal and professional contacts who may have relevant connections in the snow plowing industry.

Collaborate with:

- Landscaping companies

- Non-competing contractors such as roofing companies or home renovators

- Snow equipment suppliers

- Real estate agents

- Property management companies

- Homeowners’ Associations

Frequently Asked Questions

- Can you make money with a snow plow?

Yes, surely you can make money with a snow plowing business if you live in an area that without fail always has snow during the winter, then you likely will be profitable. If your area has snow one winter and not the next, then snow plowing could be a tough business.

Even though, you will only work in the winter season, the business is still profitable. In the U.S., the average annual pay for individuals who plow snow is $49,365 and this comes to $23.73 an hour, $949/week, or an average of $4,114/month. Some might end up earning as low as $21,500.

- How to get customers for snow removal?

You should promote your snow removal business through online platforms, local directories, or community forums. Collaborate with landscaping companies, non-competing contractors such as roofing companies or home renovators, snow equipment suppliers, real estate agents, property management companies, and Homeowners’ Associations.

Distribute flyers in neighborhoods where you offer services and offer bundled services or discounts.

- Is snow plowing hard work?

Yes, snow plowing is obviously hard work. It takes a toll on the body because you need to sit in a tight space for hours and be constantly vigilant, meaning a sore body, strained eyes, and mental fatigue.

Related Articles

1. Catchy Snow Plowing Company Name Ideas

2. Awesome Slogans for your Snow Plowing Business!

Useful Links

- Snow and Ice Management Association

- Accredited Snow Contractors Association

- Snowplowing and Ice Removal Contractor Directory